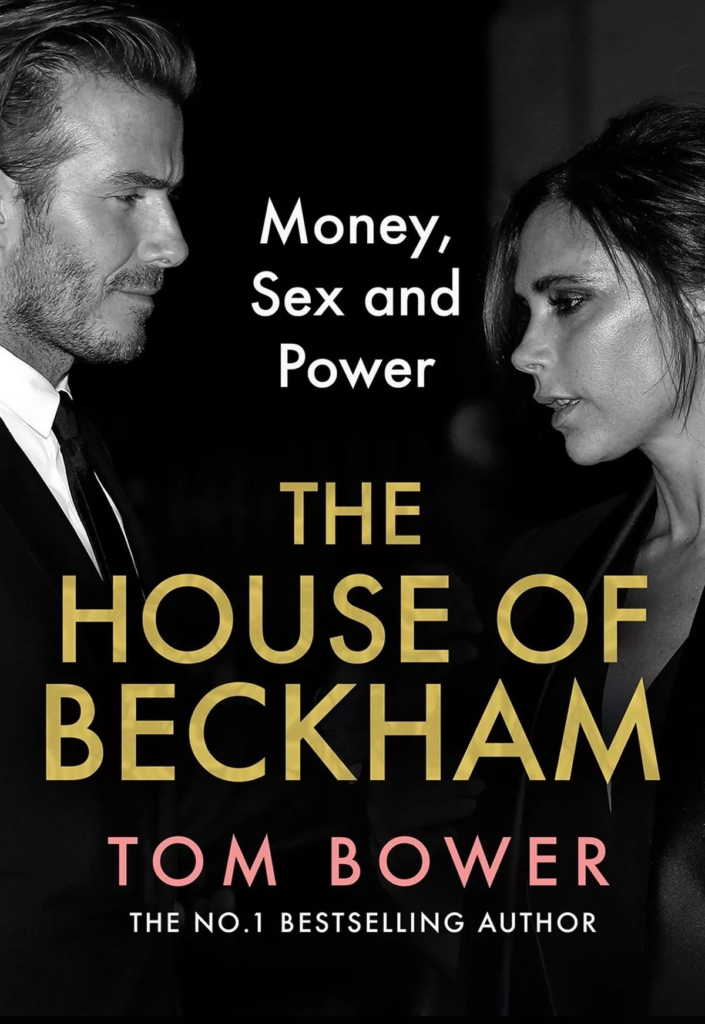

An exclusive extract from Tom Bower’s House of Beckham book claims the “money obsessed” footballer was “terrified by the prospect of sliding back into a constrained standard of living”.

David Beckham‘s hopes for a knighthood could be jeopardised by a new book delving into his previous tax affairs.

Tom Bower, the author, alleges that the footballer, who he describes as “money obsessed” regularly sought advice on how to legally reduce his UK tax payments. Beckham’s aspirations of becoming Sir David were thwarted in 2014 when HMRC raised concerns.

The book, which is being serialised exclusively over three days in the Mirror, comes as Beckham was announced last month as an ambassador for the King’s Foundation. This role, insiders suggest, could enhance his chances of receiving a knighthood.

However, Bower asserts that Beckham was less enthusiastic about the UK when it came to HMRC taxing high earners at 40 per cent.

In ‘The House of Beckham’, Bower provides a detailed account of how the football star aimed to pay less UK tax, primarily because he was “thrilled to be rich” and “terrified by the prospect of sliding back into a constrained standard of living. Opportunities to legally avoid taxes abounded,” according to Bower, reports the Mirror.

Bower goes on to describe how a forensic accountant who sifted through the star’s accounts was left “baffled” by the complexity of their “opaque” financial arrangements. He had “effectively become a non-dom” following his move to Real Madrid in 2003.

“Legally avoiding British taxes appealed to Beckham. As a non-dom in Spain he was not paying British taxes on income earned outside Britain,” Bower alleges. “And he was not paying National Insurance. The genius of it was that no one in Britain realised that Beckham had become a tax exile. Instead the public believed that he was a global success who paid his taxes in Britain.”

“Partly that was due to sightings of him in London. Legally, he could visit Britain 90 days a year and after five years the annual limit would increase to 120 days.”

Beckham is now resident in the UK for tax purposes. According to the book, his series of high-profile footballing moves abroad would often centre on what tax arrangements were in place.

“Beckham would reject the possibility of returning to the UK to play for Chelsea, would move to America rather than return to Britain, and would play for a season in France before the financial year ended,” Bower alleges. “Over the rest of his career, Beckham gave the impression that playing the tax card had become nearly as important in his life as kicking the ball.”

David Beckham’s latest quest for a knighthood could be scuppered by a new book probing his past tax affairs

Beckham had come under fire for investing in the Ingenious film financing schemes in the hope of securing tax relief. Ingenious, which helped produce movies including Avatar, qualified for tax breaks designed to support the UK film industry.

However, HMRC stated that Ingenious claimed relief on artificial losses from its films as a tax avoidance strategy. “Like other investors, Beckham had to pay the outstanding taxes which HMRC had demanded,” Bower reveals.

It’s been widely speculated that Beckham’s involvement in the scheme is why he has yet to receive a knighthood. However, Bower’s book suggests that the Honours Committee were also left scratching their heads over his financial records.

“In Beckham’s case, HMRC automatically flagged up that Beckham had legally registered as a non-dom but they were puzzled by the complexity of his companies’ accounts,” Bower alleges. “For the tax inspector, Beckham’s audited returns did not make complete sense.”

Bower’s book suggests that Beckham’s chances of receiving a knighthood were slim to begin with, given that only 16 football personalities, including Pele, Bobby Charlton and Stanley Matthews, have been knighted. “Beckham obviously believed that he ranked with those giants of the sport,” Bower asserts.

The author alleges that “Beckham’s aggressive self-promotion and tax avoidance through his non-dom status and the Ingenious schemes” didn’t sit well with Bob Kerslake, a former head of the civil service and the chairman of the Honours Committee.

Beckham’s “lavish lifestyle clashed with Kerslake’s left-wing political beliefs,” including owning five homes. “The idea of ‘Lady’ Victoria annoyed Kerslake. To make her life bearable, Victoria confessed that she employed five full-time staff, including a nanny, a chef, and two housekeepers, as well as security personnel,” Bower pens.

In leaked emails, Beckham later referred to the honours committee as “unappreciative c****”. He also dismissed the prospect of a CBE, stating: “Unless it’s a knighthood, f*** off. They’re a bunch of c****. I expected nothing less.’ Beckham’s team claimed the emails were manipulated.Bower alleges that the Beckhams’ financial affairs were “unusually intricate for a small private business owned by two people”. At the top of the hierarchy, the parent company Beckham Brand Holdings Ltd (BBH) amalgamated several associated companies and partnerships. In total, Beckham was a director of at least 19 companies in Britain and more overseas.”

Over the years, the ownership of those companies Footwork Productions, David Beckham Ventures, Victoria Beckham Ltd and many subsidiaries and their inter-company trading had even a diligent forensic accountant scratching their head about the businesses,” Bower assertsHe added: “Those internal transactions left threads that are difficult even for specialists to follow, not least because the various companies’ financial years ended at different dates.

The book alleges that staggering amounts were paid to auditors to scrutinise the books, including one payment of £437,000 for a year’s work for one firm. It was also noted that some accounts were consistently filed late at Companies House, resulting in several penalties.

In 2016, Beckham’s holding company BBH filed so late that it faced the threat of being ‘struck off.’ The book also recounts an unusual incident when Beckham’s accountants for his Seven Global Holding Company Limited had seemingly “forgotten” about taxes worth $11.3million being held by the German government in a dispute until highlighted by Bower’s forensic accountant.

Source: https://www.dailyrecord.co.uk/entertainment/new-explosive-book-reveals-david-33043218